GlobalData’s latest report, ‘Poland Source Tourism Insight, 2022 Update’, reveals that outbound travel from Poland is projected to recover to pre-pandemic levels by 2024, with international departures forecast to grow at a compound annual growth rate (CAGR) of 7.9% from 13.2 million projected international departures in 2022, to 18 million by 2025.

According to the latest statistics, Poland is observing a steady growth in tourist arrivals. In 2017 the country was visited by over 18 million visitors, and in 2018 that number increased to 19.6 million. The prediction for 2019 is well over 20 million arrivals.

Poland is indisputably becoming a top travel destination for many travelers and globetrotters from around the world. The country is well regarded as a safe and secure destination offering an affordable level of services on pair with any established travel destination. The professional incoming tourism industry and well-developed travel infrastructure provide for ease of communication, reservation, and transportation.

Far from the over tourism prevalent today in some of the more popular tourist locations, Poland offers convenient access to a multitude of attractions ranging from city breaks, cultural events, adventure travel, ecotourism, culinary experiences, heritage and religious tourism or wellness and spa.

Many travelers who visit Poland for a short break or as a part of a more extensive European vacation make a point of coming back and devoting an entire trip only to explore and discover more of this exceptional country. The upcoming 2020 shapes up to be quite an exciting time for Poland. The next year will see a whole lot of new attractions opening throughout the country.

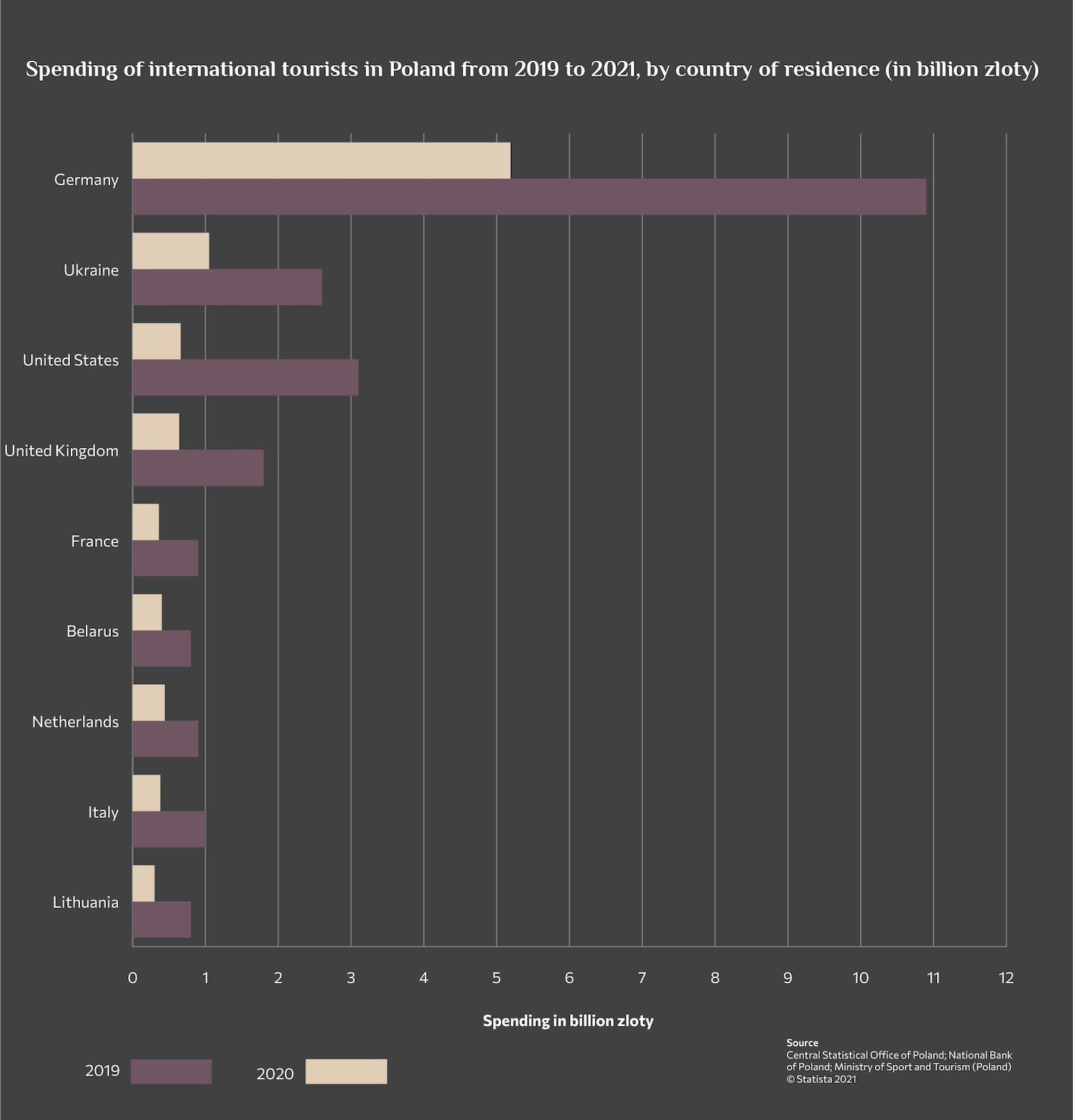

Who visits Poland the most?

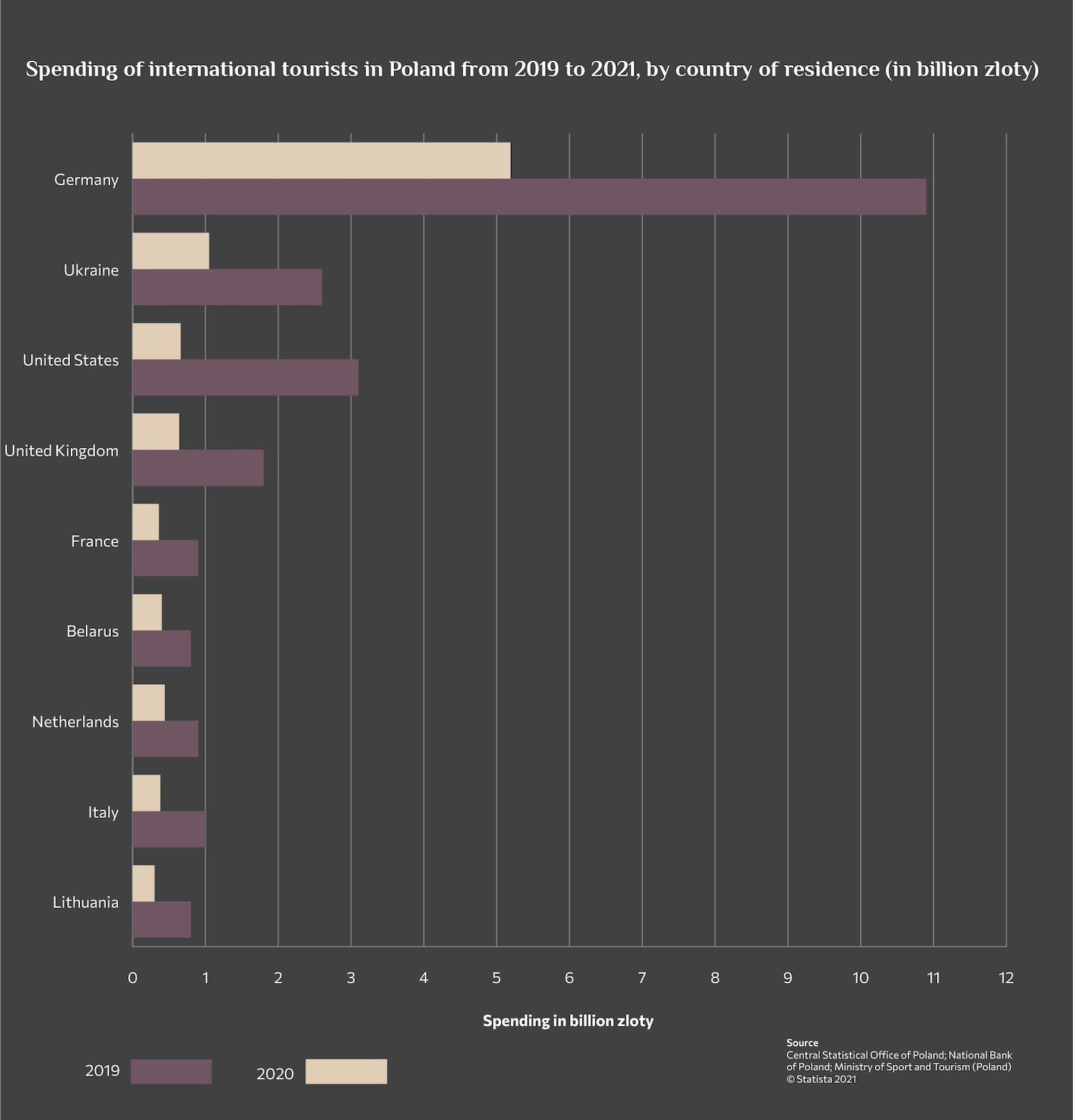

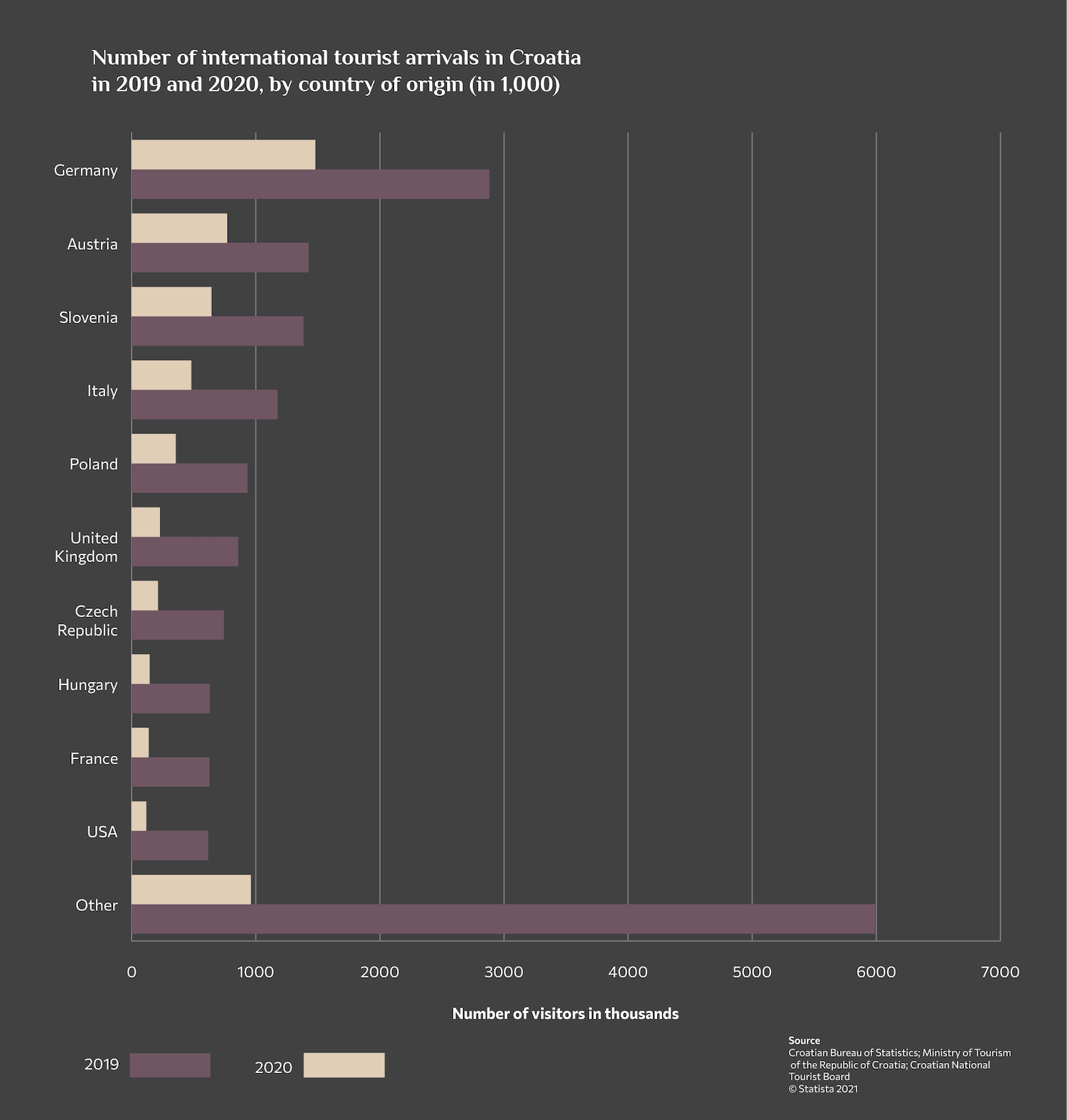

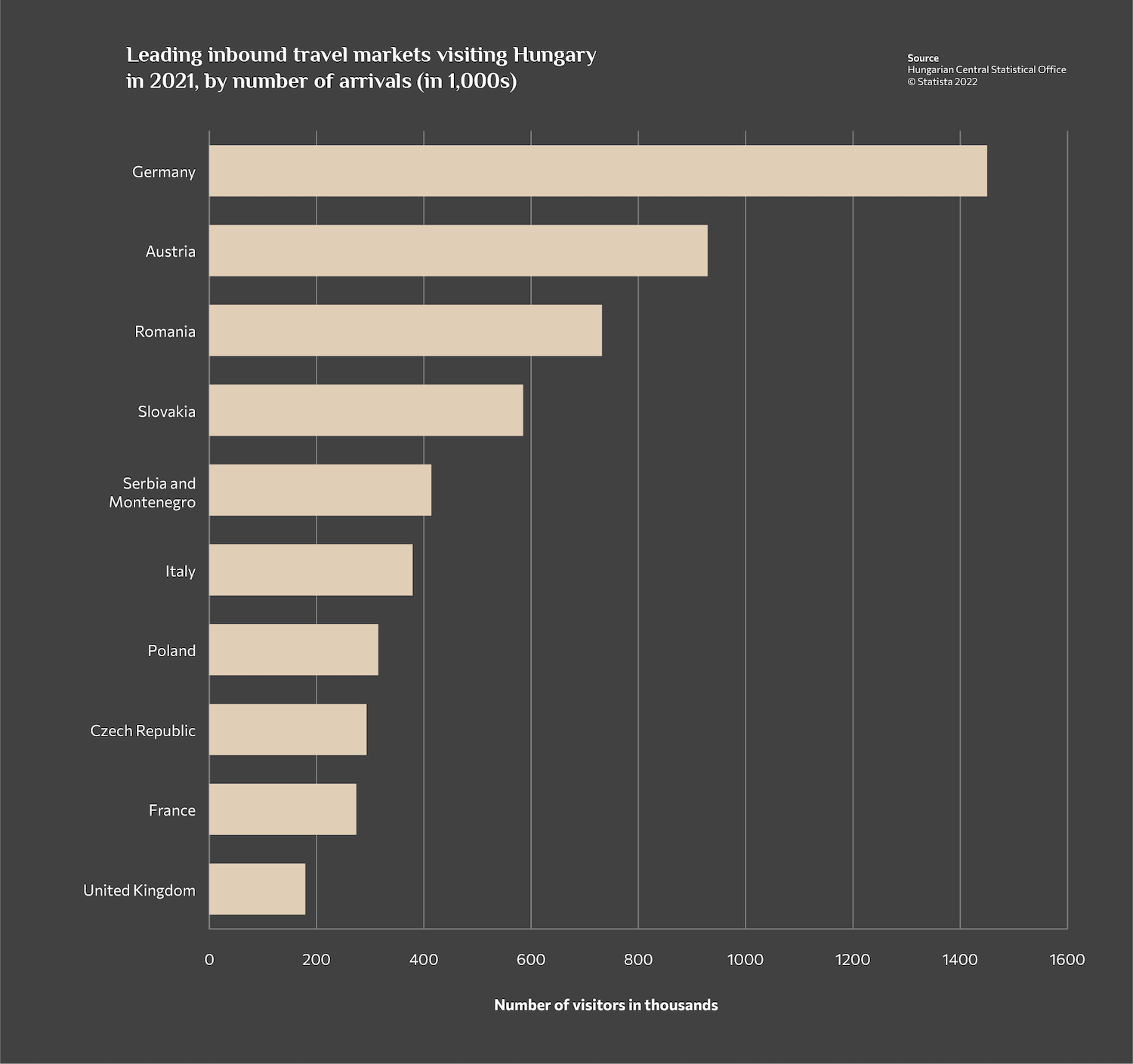

The leading country for international tourism to Poland was Germany, with residents of Germany taking over 3.4 million trips in 2020. This was followed by Ukraine and the United States of America.